You may qualify for a debt relief program if you have unsecured debt - not backed by collateral such as a house or car- totaling over $15,000.

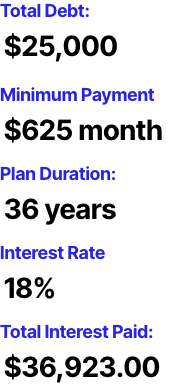

If you had $25,000 in credit card debt and paid only

the minimum each month, it would take you 36 years

to pay off the balance, which will cost you $36,923

in interest!

With a debt relief program, you could reduce the total

owed to $18,750 and pay it off in less than 48 months.

Plus, save over $200 each month!

on every monthly payment

instead of 36 years

in interest payments

Debt happens to good people. Uplift is here to help you get your financial life back on track as fast as possible.

With the help of a certified debt relief specialist, you could lower the total amount you owe and pay off your balance in a fraction of the time.

Financial pressures affect all aspects of our lives. Being unburdened by debt offers unparalleled peace of mind and flexibility.